New Delhi: Being in this business is like flying blind, said a poultry farmer from Uttar Pradesh, wrapping up a long phone call. His business, like thousands of others in the industry, in his words, is dying a slow death. “I am having second thoughts on continuing with poultry,” added the farmer who wished to not be identified by either his name or location.

The reason? Rising feed costs, wild swings in farm-gate prices (the prices received by farmers from the sale of farm produce directly to the large buyers) and demand shocks accentuated by religious practices and vigilantism.

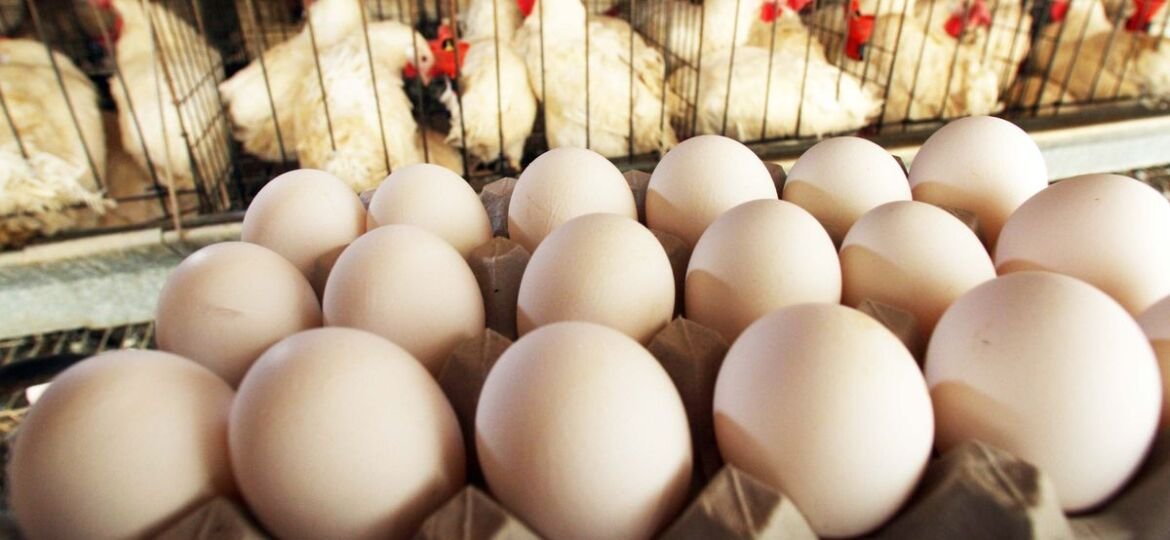

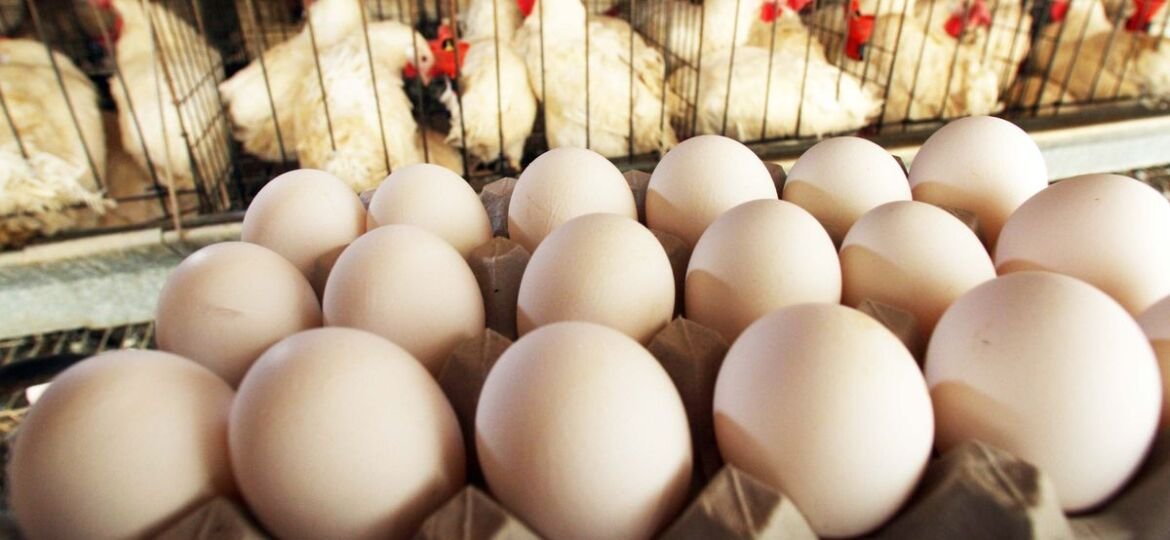

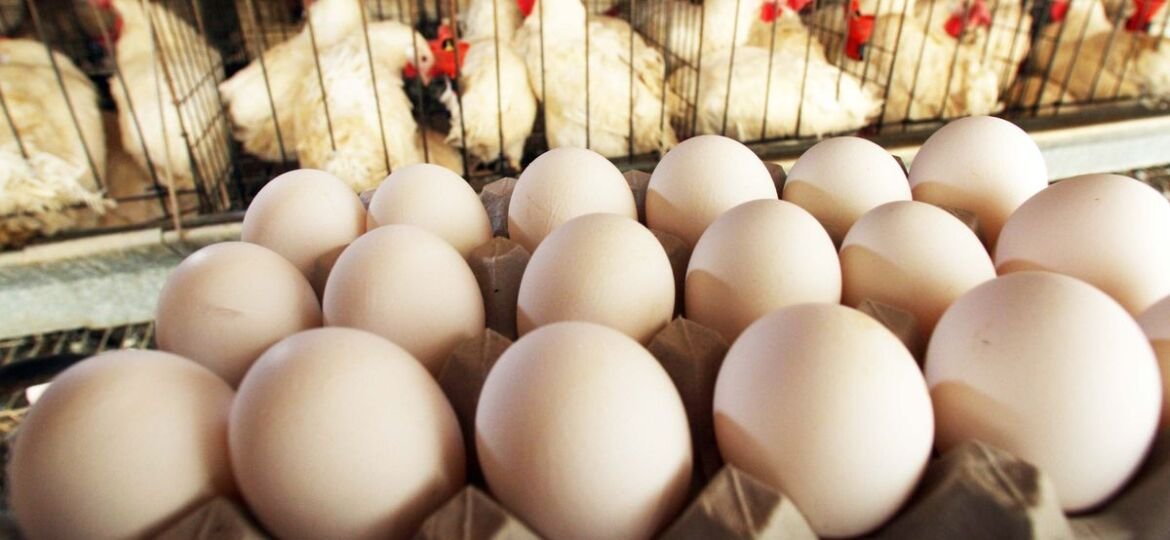

Take the wholesale price graph of eggs, for instance. On 1 May, prices were at a low of Rs 2.87 a piece in Barwala, Haryana, a major production hub in northern India. By 30 June, prices rose to Rs 5.17 — a jump of nearly 80 per cent. On 24 July, prices again fell to a low of Rs 3.30 — a steep fall of 36 per cent.

It costs a farmer around Rs 4.50 to produce an egg, and the roller coaster ride in farm-gate prices led to mounting losses in poultry businesses. The swing in producer prices was due to fluctuating demand — which usually falls during the summer.

Religious events like the Chaitra Navratri in April and the ongoing Sawan (mid-July to mid-August) led to a significant dip in demand. The ritualistic abstinence of non-vegetarian food during these periods by a section of the population in northern India, coupled with forced closure of push carts and small retailers selling eggs in some states scuttled demand, poultry owners said.

The problem, one said, is that a bird can’t be stopped from laying eggs when prices plunge. “There isn’t a switch that one can turn on and off. We continue to incur feed, energy and labour costs, and are forced to sell at huge losses.”

The poultry farmer from Uttar Pradesh quoted above, who runs a 15,000-bird layer farm, estimates his losses at around Rs 3.5 lakh in July-August.

And it’s not just eggs. Chicken prices, too, followed an equally tumultuous trajectory. In Delhi, broiler chicken rates plunged from Rs 119 per kg of live bird on 1 July to Rs 76 per kg on 23 July — a drop of 36 per cent. That compares with Rs 90-95 per kg of cost incurred by a poultry grower.

The severity of the situation can be gauged by the level of investments required to run a farm. A 15,000-bird layer (egg) farm needs a capital investment of about Rs 700 per bird, or over Rs 1 crore total. This is till about 20 weeks when the birds start laying eggs, after which farmers incur feed and maintenance costs.

Over the past year, feed costs skyrocketed, with prices of maize and soybean (de-oiled cake) rising to record highs. Currently, feed costs are 25 per cent higher year-on-year.

“After the pandemic hit in 2020 and the lockdown that followed, the poultry business went through a very rough patch including [facing] rumours (linking chicken and egg consumption to the novel coronavirus) and a bird flu episode. Many farmers could never recover from the financial hit and simply shut down,” said Yudhvir Ahlawat, a poultry owner from Karnal, Haryana.

Small growers who are unable to handle recurrent price fluctuations have entered into contract farming arrangements with large suppliers, Ahlawat said. “This has turned small poultry entrepreneurs into mere labourers and their incomes have plunged,” he added.

So, large poultry input suppliers with a presence in multiple states, such as the IB Group, Suguna Food and Skylark, are offering farmers chicks and feed — inputs they cannot afford to purchase due to lack of working capital. In return, farmers are paid Rs 7-8 for every kg of chicken they raise.

Satender Kumar from Bhiwani, Haryana, is one such contract grower rearing broiler chickens. After losing Rs 13 lakh in capital investments, Kumar, who once used to earn Rs 6-7 lakh in annual profits, now earns about Rs 30,000 per month.

“Small poultry owners cannot survive in this business anymore,” Kumar said. The risks are too many — price fluctuations, rising feed costs, disease outbreaks and even adverse weather, like the heatwave in April-May this year which led to a spike in mortality on the farm, he adds.

The industry has been on a downward spiral mode over the past three years, said Ravi Kant, another poultry business owner from Haryana. “In this industry, the big players and input suppliers manipulate daily wholesale rates. They buy eggs cheap, stock them in cold stores for months, and sell at a profit when demand recovers. There is no way a small farmer can survive this market.”

It remains to be seen how this gradual transition — from small poultry farmers to large businesses taking over the industry — impacts consumer prices in future. For now, despite the dip in wholesale prices, consumers are paying between Rs 7 and Rs 10 per egg, more than double the farm-gate price.

Source – theprint.in